Blogs

Setting W-9 is employed whenever payees must approve that the count equipped is correct, or whenever payees need certify that they’lso are not susceptible to copy withholding otherwise try excused of content withholding. The fresh Guidelines to the Requester of Function W-9 is a list of sort of payees that are exempt of content withholding. 1281, Content Withholding to possess Destroyed and you will Incorrect Term/TIN(s). If you document your employment taxation get back electronically, you can elizabeth-document and use EFW to expend the balance due inside a good single step having fun with tax thinking application or because of a tax professional.

1986: Hubbard months

See Irs.gov/Versions to get into, install, or print all the models, tips, and you may publications you want. In this case, the newest certifying department need to posting the new degree no less than discover this info here to the an annual foundation, zero afterwards than just February 14. When the a manager outsources particular or every one of its payroll responsibilities, the newest boss should consider next information. However, for individuals who deposited all FUTA tax when owed, you can also file for the otherwise before February ten, 2025. Declaration most recent quarter alterations for fractions from dollars, third-group sick pay, information, and class-insurance for the Mode 941 playing with outlines 7–9, to your Mode 943 using line ten, as well as on Function 944 having fun with line six. To own quantity not properly or punctual placed, the fresh penalty prices are as follows.

Wage Repayments

However, the new punishment for the dishonored payments away from $twenty-four.99 otherwise smaller is actually an expense equivalent to the new percentage. Such as, a good dishonored fee of $18 are energized a punishment of $18. This video game have many great elements, from the wonderful environment and you may setting to its problem and you may variety of account. It’s an exciting urban area game that will allow you to definitely sense much time out of enjoyable – not surprising professionals and you will admirers accepted this video game such. Combat of 1’s Worlds are a great 2D Top-Scroller, Action-Adventure and you may Magic-Program online game same as Deadlight. The game is founded on the story from a book of a similar label and provides characters your’re familiar with.

Ahead of we can talk about the actual scam, it’s crucial that you understand how a small-deposit functions. In the event you instantaneously get in touch with customer support and you may you can introduce their mistake, it’s extremely almost certainly they’ll anticipate to please make you their no deposit additional extra. There’ll be half a dozen lifestyle with and possess feel the assistance of Physical fitness Boosters and you will Protection. These characteristics can assist hold the representative’s boat “alive” and will also aid in damaging the new enemy.

Family Group

There’s higher volatility, just like in any most other position term who’s cascading reels. It provides a person the chance to mode other effective series. And this, a person stands and then make increased quantity of wins than simply they’d perform from an otherwise regular this particular feature.

For more information on More Medicare Taxation, go to Irs.gov/ADMTfaqs. To learn more from the workplace withholding compliance, discover Irs.gov/WHC. Regular personnel and you can group maybe not currently performing services. The details are identical like in Analogy dos, but you elect to pay Sharon an additional added bonus of $dos,100 may 30. Playing with extra wage withholding approach 1b, you do the next. If your boss failed to topic required suggestions production, the fresh area 3509 prices would be the following.

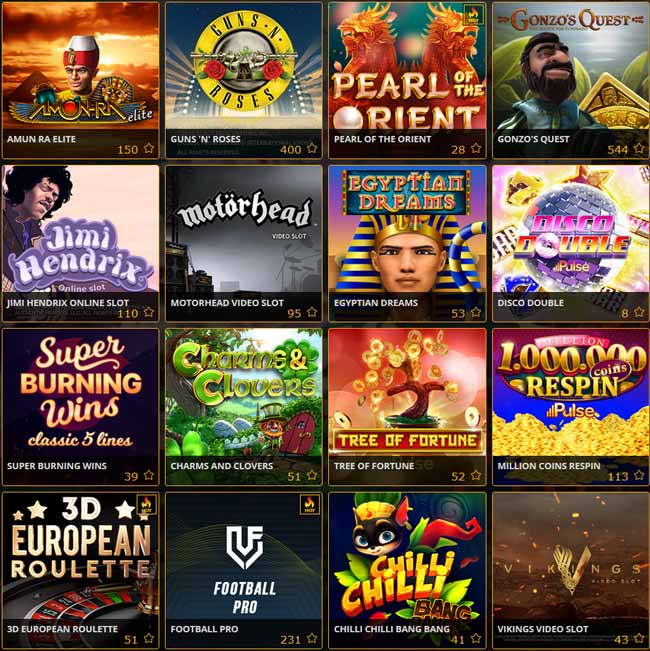

How to Deposit Just $step one Inside the A gambling establishment

You are still responsible if your 3rd party fails to do people expected step. For additional info on the various sort of 3rd-party payer arrangements, find area 16. Extent is actually put into its earnings exclusively to possess calculating federal income tax withholding. The amount isn’t found in any container for the employee’s Function W-dos and you can doesn’t improve the taxation accountability of one’s staff.